Interest Rate Parity - Chapter 7 International Arbitrage And Interest Rate Parity

Let us go through an example of how covered. Interest Rate Parity is a concept founded on the intertwined relationship between the values of currencies and the interest rates applicable to them at any given time.

The basic premise of interest rate parity is that in a global economy the price of goods should be the same everywhere.

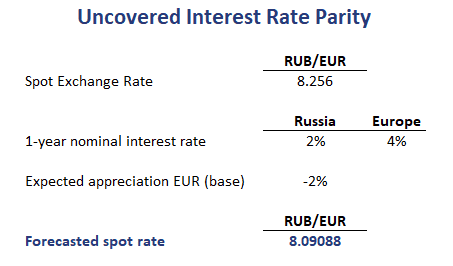

Interest rate parity. Interest Rate Parity. Key Takeaways Uncovered interest rate parity UIP is a fundamental equation in economics that governs the relationship between. Open the pages of the Wall Street Journal and you will see that Argentine bonds yiel d 10 and Japanese bonds yield 1.

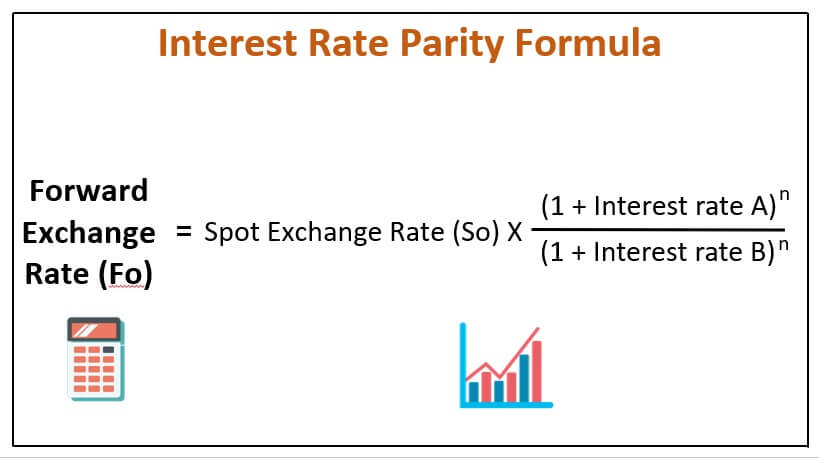

The spot rate is the current exchange rate and. The two key exchange rates are the spot rate and the forward rate. The interest rate parity explains the relationship between returns to bond investments between two countries.

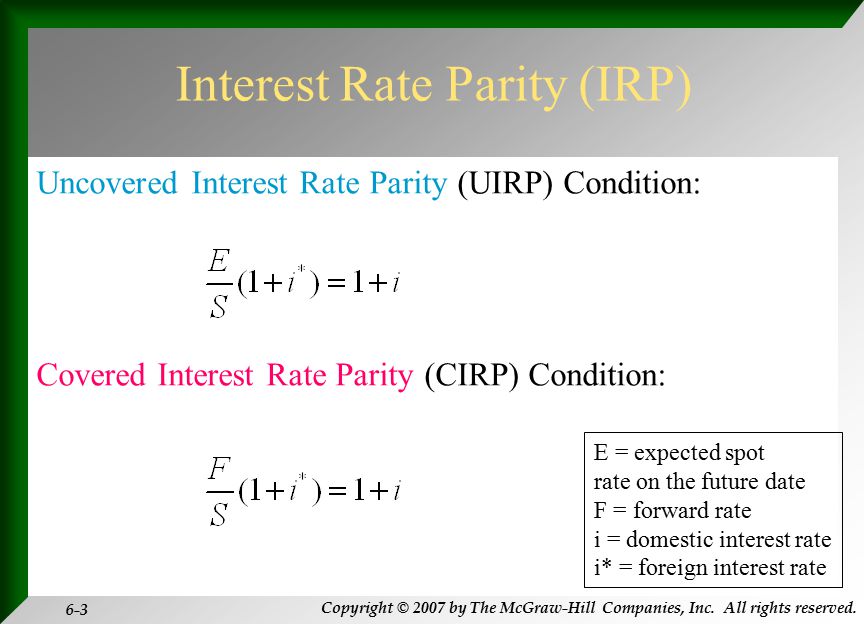

There are still some situations in which the theory of interest rate parity can be challenged. When these variables do match they are considered to be in equilibrium. Then covered interest arbitrage is no longer feasible and the equilibrium state achieved is.

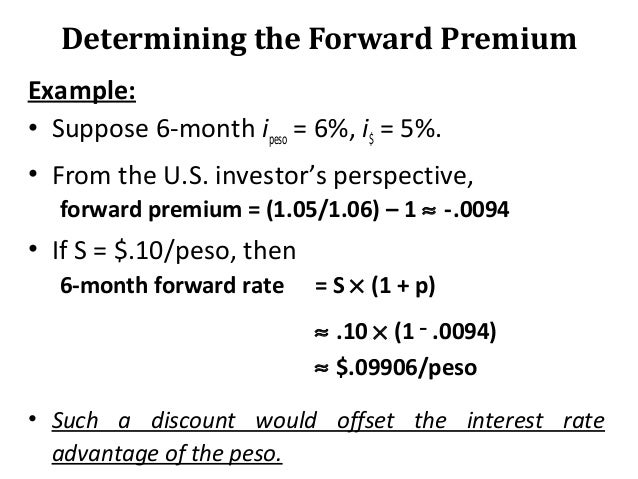

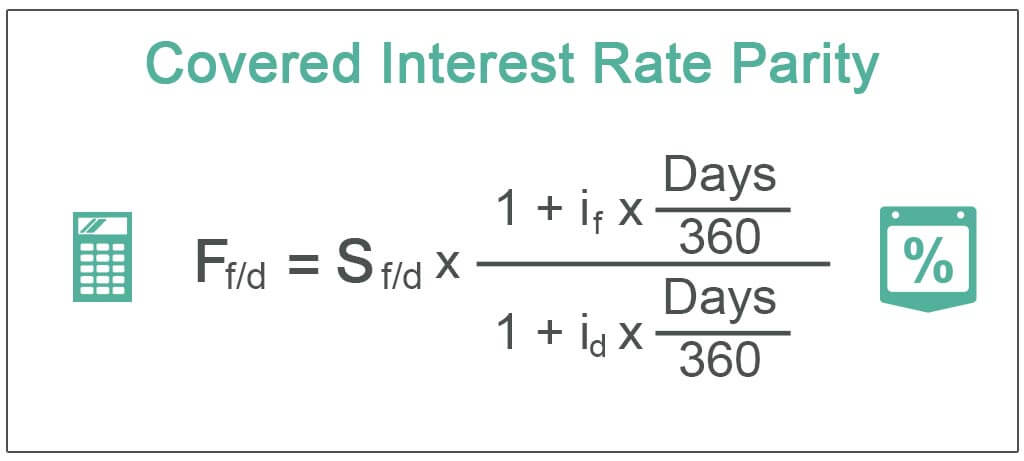

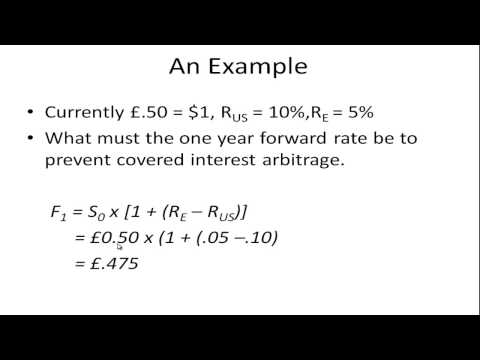

Interest Rate Parity IRP As a result of market forces the forward rate differs from the spot rate by an amount that sufficiently offsets the interest rate differential between two currencies. Covered interest rate parity simply means you are making the transaction knowing the exchange rate between two currencies. Based on a parity benchmark investors or polic y makers can analyze if a foreign currency is overvalued or undervalued I.

Interest rate parity results from profit-seeking arbitrage activity specifically covered interest rate arbitrage. Is a theory used to explain the value and movements of exchange rates. Whether you exchange at the spot rate today or set a forward rate for 30 days from now you are covering the risk of the interest rate fluctuating.

You have covered your risks. These include in certain arbitrage situations particularly as technology and algorithmic forex trading continue to. Interest rate parity provides for a degree of assurance that this will not happen and thus a stability that traders can rely on.

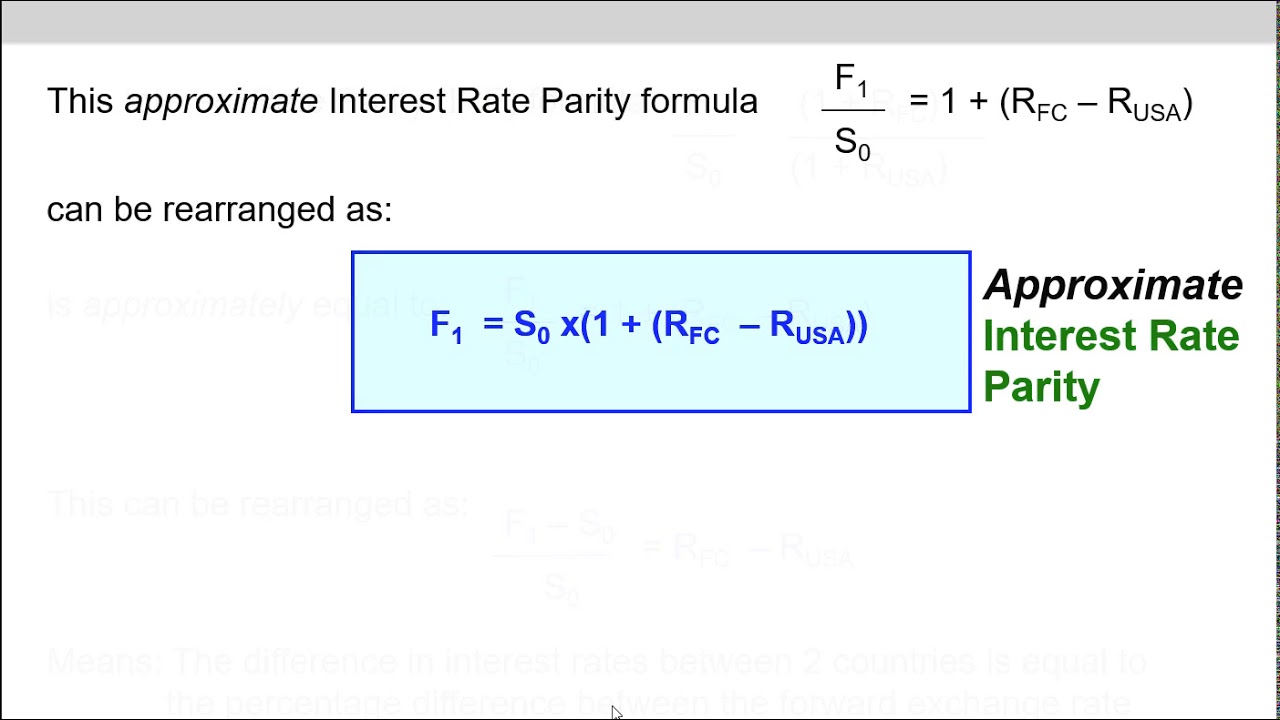

Covered Interest Rate Parity. Key Takeaways Interest rate parity is a theory that suggests a strong relationship between interest rates and the movement of currency. The theory of interest rate parity argues that the difference in interest rates between two countries should be aligned with that of their forward and spot exchange rates.

It can be used to predict the movement of exchange rates between two currencies when the risk-free interest rates of the two currencies are known. Interest Rate Parity IRP shows a theoretical relationship existing between the short-term interest rates of two countries and foreign exchange rates and it is an arbitrage condition that must hold when international financial markets are in equilibrium Eun Resnick 2007. From this concept investors and lending institutions can work out the appropriate forward rates.

Interest rate parity is a theory proposing a relationship between the interest rates of two given currencies and the spot and forward exchange rates between the currencies. It is also known as the asset approach to exchange rate determination. Interest rate parity means it doesnt.

Interest Rate Parity Theorem IRPT The IRPT is a fundamental law of international finance. Interest rate parity IRP A condition in which the rates of return on comparable assets in two countries are equal. When there is disequilibrium an opportunity for arbitrage exists.

Chapter Outline Interest Rate Parity Purchasing Power Parity Ppt Download

File Uncovered Interest Rate Parity Svg Wikimedia Commons

Interest Rate Parity Formula With Calculator

Uncovered Interest Rate Parity Breaking Down Finance

Implications Of Uncovered Interest Rate Parity Condition Personal Finance Money Stack Exchange

Interest Rate Parity Wikipedia

Exchange Rate Determination With The Help Of The Uncovered Interest Download Scientific Diagram

Chapter 7 International Arbitrage And Interest Rate Parity

13 Of 18 Ch 21 Uncovered Interest Parity Youtube

Covered Interest Rate Parity Cirp Definition Formula Example

How To Interpret Correctly The Uncovered Interest Rate Parity Condition Economics Stack Exchange

Interest Rate Parity How To Discuss

Exchange Rates Interest Rates And Interest Parity Ppt Download

Fin 40500 International Finance Interest Rate Parity Spot

Purchasing Power Parity Interest Rate Parity International Corporate

10 Of 18 Ch 21 Interest Rate Parity Derivation Of Formula Youtube